Payment Origination — Limited

Originate ACH, wires and books transfers, and open bank accounts. In the Limited use case, you can test this out through moving and storing your own funds in production.

Overview

The Payment Origination — Limited configuration enables you to move your own money around the U.S. payments ecosystem. Quite simply, you will have your own bank account(s) at Column which will give you direct access to the payment rails of the US financial system. This means that from your bank account, you will be able to both originate and receive ACH Credits, ACH Debits, wire transfers, as well as book transfer funds between your own accounts at Column (Checks are in beta, International wires and RTP are coming soon). As a developer, you can access these payments rails both through our dashboard and via API on day 1. In summary, you will immediately be able to use our API to move your own money around the US banking system!

This is purpose-built for companies and their developers to understand and evaluate Column as an infrastructure bank, by moving real money in production right away (with $ volume limits). This self-serve configuration it is not meant to be used as a purposed bank account for businesses to conduct day-to-day operations.

How it works

To begin moving your own money, start by creating a Column bank account in your name or your company's name. We allow you to originate ACH credits and wire payments at this point (send money from your external bank account to Column, and send money from your Column bank account to another external bank account). Once you fund your reserve account, you'll be able to originate ACH debits from your Column account. If you'd like to originate payments in amounts higher than the limits we set, we'll work with you to make that happen.

Note: You will not be able to create entities, other than your root entity. Non-root entities are typically used to create bank accounts for other people, which is not what this use case is intended for.

Example

A developer at Pam's Payments, which provides Bill Pay functionality to other businesses, is helping their company evaluate options for a partner bank. They sign up for Column, try out all features and functionality in sandbox, and leverage this use case to move a small amount of their own money in production. This allows them to see what it's like to open a bank account and move real funds with Column.

Considerations & Risks

Returned ACH Debits is a key risk to be aware of. When using a Column bank account you will have the ability to pull money in to your account from an external account. The account from which you are pulling funds has up to 60 days to tell Column that this transfer of funds is unauthorized. When Column receives these requests, we are obliged to honor them and will pull funds from your bank account to do this. If there are not enough funds in your account, we will draw down your program reserve account at Column. This is why we mandate that your program reserve account is funded at or above your ACH debit transaction volume over the last 60 days.

Benefits of this use case

- Virtually zero overhead to open up a bank account at Column.

- Get direct access to the US financial banking rails with minimal friction.

- See what it's like to move real funds with Column.

Drawbacks of this use case

- This self-serve flow can only be used for testing and evaluation purposes and cannot be used as an operational bank account for you or your business.

- Because this should be used for evaluation, transaction size and overall volume limits are relatively low ($100 and $1,000, respectively).

- You must post reserves to cover 100% of t+60 ACH debit transaction volume to your program reserve.

Compliance & Legal Requirements

In order to go into production with this use case, the following tasks must be completed. This can all be done in Column's dashboard.

- Column will conduct Know-Your-Customer and/or Know Your Business checks on you or your business, based on information you provide.

- You will need to agree to an electronics communications agreement and deposit account agreement in order to open a bank account with Column.

- You will need to gain proper authorization from the counter-party for any payment origination.

Implementation steps

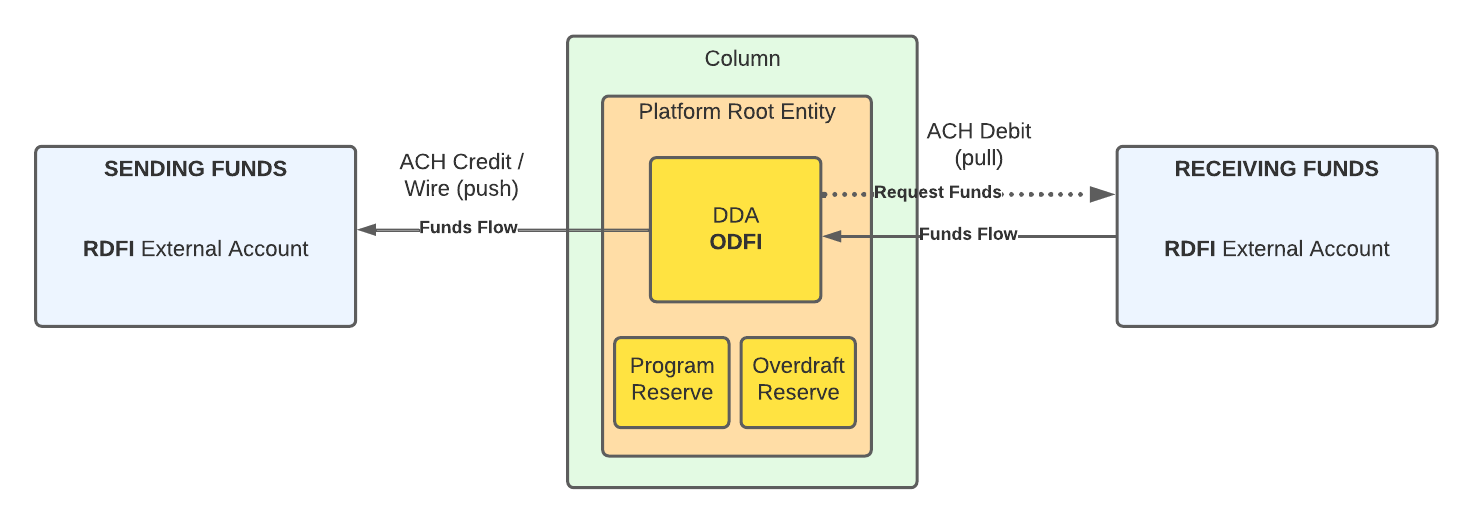

Create your data model

- One Root Entity which has gone through KYC / KYB

- Program Reserve and Overdraft reserve Bank Accounts (created automatically) which belong to the root entity. See here for more information on these accounts.

- One or more DDA bank account(s) which also belong to the root entity.

Flow of funds

Step-by-step flows for money movement

- Switch your platform to live mode

- Create a bank account for the root entity

- Transfer funds in and out of your bank account

- Try out some other features

Switch your platform to live mode

To switch your platform to live mode, follow the instructions here.

Create a bank account for the root entity

In order to start transfering funds, you'll need to create a bank account under your root entity. The funds you've added to your program reserve account are locked and cannot be moved. These funds are to collateralize any ACH debits you want to make. More information here.

You can create a bank account under your root entity both through the Column dashboard and via the Column API.

Transfer funds in and out of your bank account

There are three key payment rails you can use to move money with Column. ACH, Wire, and Book transfers. Payment rails can be accessed both by using the Column Dashboard, and by using the Column API.

ACH

See our ACH overview docs and the ACH API docs for more information.

Counterparties

Before you can originate an ACH from Column (both debit and credit), you'll need to create a counterparty in our system. Creating a counterparty in our system makes it easy to originate ACH transfers to the same external bank account in the future. We also build in some safeguards, such as validating that the routing number is recognized by the Federal Reserve.

Wire

See our wire overview docs and the wire API docs for more information.

Counterparties

Before you can originate a wire from Column, you'll need to create a counterparty in our system. Unlike for an ACH transfer, the wire object is required in the counterparty.

Book transfer

See our book transfer overview docs and the book transfer API docs for more information

Try out some other features

Ready to start? Sign Up or Log In to your Column dashboard to begin!