Guide

Card Programs with Column

Build a card program with Column to offer your customers any type of card. We work with all major networks and issuer processors.

Overview

Now that you've got a sense of the core elements of a card issuing program, let's dig in on how you can stand up your card program with Column as your BIN Sponsor. As a reminder, the BIN sponsor is the financial institution who is a principal member of the card networks and whose BIN is used on cards for the program.

Column partners with all types of companies for their card programs, ranging from high growth startups to multi-national enterprises. Most companies are looking to manage elements of their own card programs and want the flexibility, visibility and control that comes with working directly with a technology-first, nationally chartered bank.

How it works

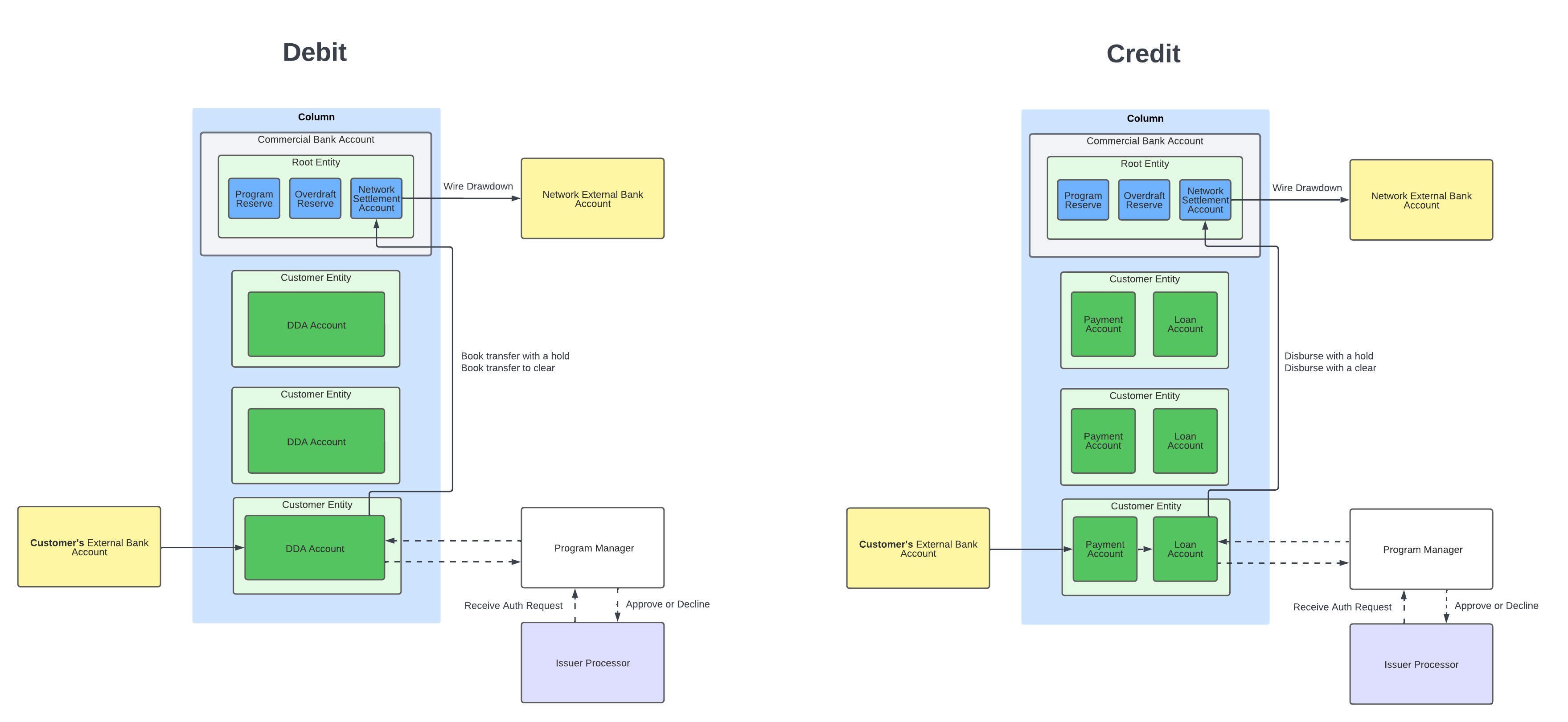

Column partners with companies to operate debit, credit, prepaid (and more types) card program for both consumers and businesses. For debit and prepaid cards, funds sit with Column to facilitate transactions, help ease authorization and settlement flows, and streamline reconciliation. For credit and charge cards, Column originates credit and generates receivables associate with users' card spend.

When launching with Column, you will operate as an agent of the bank and the relationship will be outlined in a Program Management Agreement.

To develop a card program with Column, you'll need to ensure you can take on certain program manager responsibilities and choose an issuer processor to pass network messages. As a BIN sponsor, Column performs a number of key activities and responsibilities for your card program.

- Network membership & BIN ownership — Column will own the BIN (consumer/commercial & debit/credit/prepaid) and maintain its membership as a principal issuing member of card networks for the duration of the program. Today, Column is able to issue cards on Visa, Mastercard and Discover.

- Settlement — Column facilitates settlement with the card networks to satisfy obligations from transactions. The settlement account is funded from users' accounts (debit) or loans from Column (credit) to ensure that daily settlement via wire drawdown executes successfully.

- Program oversight — Column works with you to provide regular reporting to regulators and networks related to program performance. There is also ongoing communication and coordination with partners on program adjustments, user activity exceptions, follow up diligence requirements, program testing, and other required items.

- Transaction monitoring — Column will request information from you to perform BSA/AML transaction monitoring and OFAC/Sanctions screening to ensure that programs remain compliant and any potential bad actors are identified and investigated with your help.

As the Program Manager, you must integrate with Column and the Issuer Processor so you can leverage Column's APIs to check account balances (debit) or maximum credit limits (credit) to approve/decline card transactions appropriately.

Compliance & Legal Requirements

There are Compliance, Legal, and Operational requirements in order to partner with Column on a card program. As a reminder, certain situations may necessitate additional requirements.

- Know Your Business: Column will conduct KYB checks based on information we ask you provide.

- Electronics Communications Agreement: You will be asked to agree to this.

- Deposit account agreement: In order to open your root bank account with Column, you'll be asked to agree to this.

- Bank Secrecy Act / Anti-Money Laundering (BSA / AML): To fulfill regulatory requirements around BSA / AML, you'll be required to perform Know Your Customer / Know Your Business verification on all your customers. There are a number of vendors that can help with this. You'll also have to provide policies documenting your Customer Identification Program (CIP), BSA / AML Compliance and OFAC checks. Column can help you get started with these policies if you do not already have them.

- Customer Application and / or Onboarding: We'll ask you to provide an overview of how you take in customer applications and how you onboard your customers to your products.

- Proposed Terms of Use (which you would provide to your customers): Column will review your Terms of Use and provide feedback on suggested revisions, as needed.

- Rewards Terms: We'll ask you to provide the reward terms for your card program as these are associated with Column bank accounts.

- ACH Risk: You'll be asked to validate that you have a way of assessing ACH risk involved in originating payments for your customers, and that you are getting the proper authorizations for any ACH origination.

- Data Safeguarding Checklist & Privacy Policy: You'll need to validate that you are following guidelines for data safeguarding and provide your company's privacy policy.

- Governmental Issues and Litigation: You'll need to provide context for and copies of any pending or actual government inquiries, investigations, CIDs, and/or enforcement actions, since inception, and pending or threatened litigation and any/all litigation involving company since inception.

- Marketing Guidelines & Reviews: We'll provide you with Column's Marketing guidelines to adhere to, and ask you to provide insight into your Marketing process, policy and materials.

- Vendor Management: You'll need to provide your Vendor Management Policy as well as a list of your third party vendors.

- Fraud Monitoring, Complaints, and Disputes Process: You'll need to monitor your customer activity for fraudulent transactions, and have a process for ingesting complaints and actioning disputes (you may decide to enlist your issuer processor to help you here).

- Card production: Card production and fulfillment is an important part of your responsibilities which is also offered by your issuer processor. This includes ordering physical card stock, arranging card carriers, monitoring user acceptance testing (UAT), and facilitating delivery of cards to users. Common vendors include IDEMIA, CPI, Tag Systems, Perfect Plastic, Composecure, Arroweye, ABCorp and others.

- Customer Support: You'll need to manage aspects of the customer experience, such as your contact info being listed on the back of the card and in the Deposit Account and Cardholder Agreement associated with your program. You will need to follow up on any customer issues and respond to inquiries from your customers received by Column, in a timely fashion.

- Customer Electronic Communications Agreement and Deposit Account and Cardholder Agreement: You'll need to provide your customers with an Electronic Communications Agreement, and the correct Deposit Account and Cardholder Agreement prior to their onboarding.

- Consumer bank account policies: If you are creating bank accounts for consumers, you will need to have a number of policies such as Truth in Savings Act, Electronic Funds Transfer Act, Expedited Funds Availability Act and Error resolution policy and procedures. Column can help you with these policies if you do not already have them.

- Consumer bank account program management: If you are creating bank accounts for consumers, you will need to provide your customers with periodic statements, a customer service phone number, and a process for dispute intake and resolution.

- Credit/charge card materials: For credit and charge card programs, you will need to provide lending-related materials including items like servicing and collection policy and procedures, credit model, and loan processing materials. You will also need to work with Column on underwriting for your program.

- Authorization: As Program Manager, you sit in the authorization flow which allows you to approve or decline transactions. You can reference account balances or credit limits at Column to make the authorization decision but the power is in your hands. It is the Program Manager's responsibility to ensure the network message is responded to within the network's and processor's stated time frame. For example, Visa requires that authorization messages are responded to within 10 seconds for standard POS, but some processors require a response within 2 seconds or they'll use your default settings to approve or decline the transaction.

As Program Manager, you're responsible for any losses and expenses for your program, including network fees, fraud losses, and other penalties. Therefore, it is extremely important that you have robust tools in place to maintain compliance, monitor fraud, and manage adherence to network rules.

Financial due diligence

In order to provide you with a reduced program reserve amount, we ask you to submit basic information about your company and standard financial statements so we can properly evaluate the financial and operational risks of partnering together. This includes, but may not be limited to: Company overview, Compliance team overview (if you have one), most recent Financial Statements, and all on and off balance sheet liabilities.

There may also be requests associated with your issuer processor partner and from the appropriate card network as you get onboarded.

Timeline

Once you've signed your agreements with Column, have tested in the sandbox, and started on due diligence, you'll work through the phases to launch. That includes BIN allocation and program setup, API integration with Column and finally testing, migration and launch.

Many of these phases can be run in parallel but some require sequencing (e.g. secondary debit network, card fulfillment post card design). Given supply and demand considerations and custom card requirements, card fulfillment can be a lengthy process and can only be done after card design approval. Fortunately, your integration with Column is often one of the quickest and straightforward items in the list.

Timelines for custom cards typically run 90-120 days, inclusive of card design, settlement structuring, BIN implementation, and other activations (e.g. Visa Direct and Mastercard Send).

Implementation steps

Create your data model

- One Root Entity which has gone through KYC / KYB

- Program Reserve and Overdraft reserve Bank Accounts (created automatically) which belong to the root entity. See here for more information on these accounts.

- Under root entity, create settlement account which will be used for daily settlement with card networks.

- An entity for each end consumer/business which has gone through KYC / KYB

- Create a bank account for each consumer/business entity

- Create a loan object for each consumer/business entity (credit only)

Flow of funds

Switch your platform to live mode

To switch your platform to live mode, follow the instructions here.

Create non-root entities and accounts

You should create an entity and account for each customer for whom you are opening a demand deposit account. Non-root entities and accounts can be created both via the dashboard and with the API. Each entity you create needs to go through KYC/KYB.

Implement the flow of funds workflow

- When you receive an authorization request from the issuer processor, attempt a book transfer (with hold) or disbursement (with hold) from the user's account / loan to the network settlement account.

- If successful, approve the auth request. If unsucessful, decline the auth request.

- When receiving the clear message from issuer processor clear the previous book transfer or disbursement with hold status.

- Card networks will issue a wire drawdown to the network settlement account at regular intervals.

- (Credit only) To make a loan payment, issue an ACH debit from the user's bank account to their external account. Once the ACH debit settles, make a payment from the user's bank account to the loan.