Payment Facilitation

Level of effort: Easy + some compliance requirements

Overview

The Payment facilitation use case enables you to move money on your customers’ behalf. You will have a bank account(s) at Column which provides direct access to the payment rails of the US financial system. You will be able to transfer funds on behalf of your customers to power financial products such as bill pay, payroll, accounts receivables, accounts payables, digital wallets, and many situations where you are acting as an intermediary to facilitate transactions between two parties.

How it works

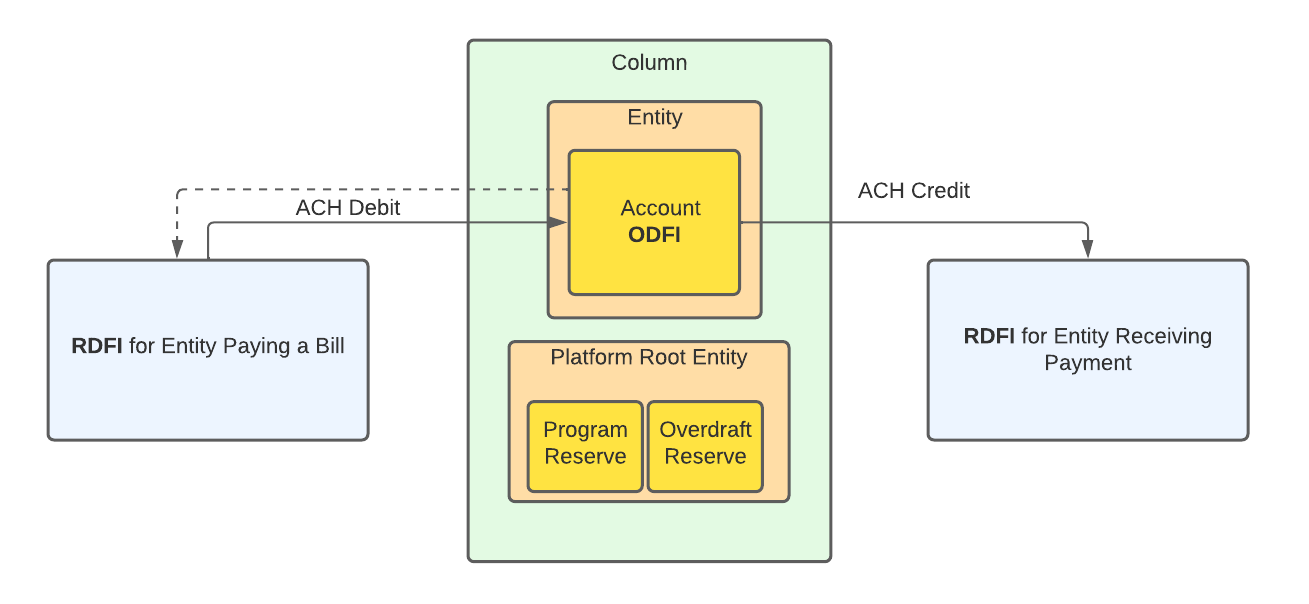

In this configuration, a Column bank account is used to pass-through and hold funds on behalf of your customers. This account is in Column's name and for the benefit (FBO) of your customers, and leverages Column's system of record (ledger) to keep track of all the customer transactions. You will have a “Third-Party-Sender” agreement in place with Column, which is a regulatory requirement for payment facilitation use cases.

You will need to build a front end interface which uses the Column banking APIs to power fund flows. For example, your interface can:

- Allow your customers to input their own bank account information.

- Allow your customers to track their account receivables and send invoices.

- When an invoice is received, allow the account payer to input their own bank account information.

- Execute a transaction on the Column APIs which pull money from the payer and push money to the receiver.

Example Use Case

Bill’s Bakery needs to transact with Phil’s Flour in order to get the ingredients needed for this week’s blueberry muffin production. Phil’s Flour provides their product to a few dozen local bakeries (like Marie’s Muffins, Chris’s Croissants, and Brian’s Baguettes). Because they have so many vendors, Phil’s Flour chooses to manage their account receivables through a modern bill pay app called Pam’s Payments. Pam’s Payments has a slick interface which enables Phil’s Flour to send invoices to the their partner bakeries. When Bill’s bakery gets an invoice, they input their bank account information into the app. Under the hood, Pam’s payments is using a Column payment facilitation configuration to pull money from Bill’s Bakery and send it to Phil’s Flour.

Considerations & Risks

Returned ACH Debits is a key risk to be aware of. When using a Column bank account to pull money from an external account, the account from which you are pulling funds has up to 60 days to tell Column that this transfer of funds is unauthorized (this goes down to 2 days when pulling funds from a business entity instead of a consumer entity). When Column receives these requests, we are obliged to honor them and therefore this risk.

In this use case, you are may be subject to rules and regulations around having custody of funds of your end customers. We recommend discussing this with your legal counsel.

As with many financial products, the Bank Secrecy Act and Anti-Money Laundering regulations are a key consideration. You'll want to learn about these regulations and how to ensure you remain compliant with them, which is something Column can help you with.

Benefits of this use case

- You may not need money transmission licenses (MTLs, MSBs) as we propose a configuration in which your business does not have legal custody of your customers' funds.

- Compliance requirements are fewer in this use case than when you offer bank accounts [link to bank accounts use case guide] because you are not opening bank accounts on behalf of your customers.

- You can still move and hold funds on behalf of your customers, and leverage our ledger [link to website ledger section] functionality as a system of record.

Drawbacks of this use case

- You cannot market that you are creating bank accounts for your customers.

- If you decide you want to offer cards to your customers, you may have to migrate to a bank accounts based structure in order to do so.

Compliance & Legal Requirements

Please see below for the list of Compliance and Legal requirements in order to leverage this use case for your financial product(s). As a reminder, certain situations may necessitate additional items.

- Know Your Business checks on your business: Column will conduct KYB checks based on information we ask you provide.

- Electronics Communications Agreement: You will be asked to agree to this.

- Deposit account agreement: In order to open your root bank account with Column, you’ll be asked to agree to this.

- Bank Secrecy Act / Anti-Money La undering (BSA / AML): To fulfill regulatory requirements BSA / AML, you'll be required to perform Know Your Customer / Know Your Business verification on all your customers (there are vendors that can help with this). You'll also have to provide policies documenting your Customer Identification Program (CIP), BSA / AML Compliance and OFAC checks. Column can help you get started with these policies if you do not already have them.

- Customer Application and / or Onboarding: We'll ask you to provide an overview of how you take in customer applications and how you onboard your customers onto your products.

- Proposed Terms and Conditions (which you would provide to your customers): you will need to provide these to Column and we will help provide necessary language to include in these T&Cs.

- ACH Risk Assessment Policy: Validate that you have a way of assessing ACH risk and that you are getting the proper authorizations for any ACH origination.

- Data safeguarding checklist & Privacy Policy: You will need to validate that you are following guidelines for Data safeguarding and provide your company's privacy policy.

- Pending or actual government inquiries, investigations, CIDs, and/or enforcement actions, since inception, and pending or threatened litigation and any/all litigation involving company since inception: If applicable, we will need you to submit a list of of all these elements, as well as copies.

Financial Due Diligence

In order to provide you with a reduced reserve amount, we ask you to submit basic information about your company and standard financial statements so we can properly evaluate the financial and operational risks of partnering together. This includes, but may not be limited to: Company overview, Compliance team overview (if you have one), most recent Financial Statements, all liabilities (on and off balance sheet).

Implementation steps

Create your data model

- One Root Entity which has gone through KYC / KYB

- Program Reserve and Overdraft reserve Bank Accounts (created automatically) which belong to the root entity. See here for more information on these accounts.

- One non-root entity for each of your customers.

- One account created for each entity. Note, this is not a DDA account and cannot be marketed as a bank account.

Flow of funds

Step-by-step flows for money movement

- Switch your platform to live mode

- Create non-root entities and accounts

- Create a two-legged transaction

Switch your platform to live mode

To switch your platform to live mode, follow the instructions here.

Create non-root entities and accounts

You should create an entity and account for each customer for whom you are originating payments on their behalf. Non-root entities and accounts can be created both via the dashboard and with the API. Each entity you create needs to go through KYC/KYB.

Create a two-legged transaction

Payment facilitation use cases typically involve a two-legged transaction, where funds are debited from one party (through an ACH debit) and credited to another party (through an ACH credit). Two-legged transactions should flow through the account for the entity which is originating the payment.

Check out this page for step-by-step instructions on creating a two-legged transaction in Column.