Bank Accounts

Overview

Using this configuration, you have the ability to open bank accounts at Column for your customers (consumers and / or businesses). Your customers will have their very own FDIC-insured demand deposit account at Column. As with our other use cases, we provide the payment rails (Wire, ACH, book transfers, checks in beta, and soon international payments), which enable these bank accounts to transact with the US Banking ecosystem.

The ability to create bank accounts for end-customers is designed primarily for neobanks and other financial products where you want to provide your customers with their own bank account and be able to market that specific offering. Bank Accounts also serves as the foundation for many card based use cases (debit, credit, charge...etc), which you can read about here. If you are thinking about providing a digital wallet to your customers (but not necessarily a bank account in their name), you may be able to do that with a lower Compliance burden through our Payment Facilitation use case.

How it works

In order to open bank accounts for your customers, we would be partnering under a Program Management Agreement, which would mean you would acting as a third party service provider for Column.

You can leverage Column's APIs to automatically create bank accounts for your customers when you onboard them onto your product. And you will be able to originate transactions on U.S. payment rails to and from these bank accounts, on behalf of your customers.

In order to create bank accounts for your customers, you'll need to ensure you can take on certain program manager responsibilities, which are mostly required if you are opening bank accounts for consumer purposes (vs. commercial / business purposes).

Example Use Case

Nina’s Neobank is a banking platform which caters specifically to bakeries. Nina’s Neobank offers core banking services such as checking accounts, debit/credit cards, and the ability to pay vendors. Nina’s Neobank also offers some unique perks, such as extra rewards for wholesale flour purchases and social media advertising purchases. Because Marie’s Muffins buys a lot of flour, uses social media ads to acquire customers, and has a lot of vendors to manage, using Nina’s Neobank is an obvious choice.

Nina’s Neobank is built on Column. Under the hood, funds for Marie’s Muffins are stored in an FDIC insured bank account at Column. When Marie’s Muffins pays a vendor, Nina’s Neobank is using a Column API to transfer funds from Marie’s Muffins to the vendor’s bank account.

Considerations & Risks

Returned ACH Debits is a key risk to be aware of. When using a Column bank account to pull money from an external account, the account from which you are pulling funds has up to 60 days to tell Column that this transfer of funds is unauthorized (this goes down to 2 days when pulling funds from a business entity instead of a consumer entity). When Column receives these requests, we are obliged to honor them and therefore this risk.

In this use case, you are may be subject to rules and regulations around having custody of funds of your end customers. We recommend discussing this with your legal counsel.

As with many financial products, the Bank Secrecy Act and Anti-Money Laundering regulations are a key consideration. You'll want to learn about these regulations and how to ensure you remain compliant with them, which is something Column can help you with.

With the Bank Accounts use case, you also need to ensure you are compliant with UDAAP regulation by abiding by Marketing guidelines.

Benefits of this use case

- You are able to market this as a bank account to your customers.

- Column will be the ledger / system of record for your customers bank accounts.

- Bank accounts serve as a foundation for card programs.

Drawbacks of this use case

- There is additional compliance and legal overhead.

Compliance & Legal Requirements

Please see below for the list of Compliance, Program Manager and Legal requirements in order to leverage this use case for your Financial product(s). As a reminder, certain situations may necessitate additional requirements.

- Know Your Business checks on your business: Column will conduct KYB checks based on information we ask you provide.

- Electronics Communications Agreement: You will be asked to agree to this.

- Deposit account agreement: In order to open your root bank account with Column, you’ll be asked to agree to this.Bank Secrecy

- Act / Anti-Money Laundering (BSA / AML): To fulfill regulatory requirements BSA / AML, you'll be required to perform Know Your Customer / Know Your Business verification on all your customers (there are vendors that can help with this). You'll also have to provide policies documenting your Customer Identification Program (CIP), BSA / AML Compliance and OFAC checks. Column can help you get started with these policies if you do not already have them.

- Customer Application and / or Onboarding: We'll ask you to provide an overview of how you take in customer applications and how you onboard your customers onto your products.

- Proposed Terms and Conditions (which you would provide to your customers): you will need to provide these to Column and we will help provide necessary language to include in these T&Cs.

- ACH Risk Assessment Policy: Validate that you have a way of assessing ACH risk and that you are getting the proper authorizations for any ACH origination.

- Data safeguarding checklist & Privacy Policy: You will need to validate that you are following guidelines for Data safeguarding and provide your company's privacy policy.

- Pending or actual government inquiries, investigations, CIDs, and/or enforcement actions, since inception, and pending or threatened litigation and any/all litigation involving company since inception: If applicable, we will need you to submit a list of of all these elements, as well as copies.

- Marketing Guidelines and Reviews: We'll provide you with Column's Marketing guidelines and ask you to provide insight into your own Marketing process and policy.

- Vendor Management: You'll ask you to provide your Vendor Management Policy as well as a list of your third party vendors.

- Fraud Monitoring & Complaints Process: You'll need to take on fraud monitoring responsibilities to monitor your customer accounts for fraudulent transactions, and have a process for ingesting and actioning Complaints.

- Customer Electronic Communications Agreement and Deposit Account Agreement: You'll need to provide your customers with an Electronic Communications agreement and the correct deposit account agreement prior to their onboarding.

- Consumer bank account policies: If you are creating bank accounts for consumers, you will need to have a number of policies such as Truth in Savings Act, Electronic Funds Transfer Act, Expedited Funds Availability Act and Error resolution policy and procedures. Column can help you with these policies if you do not already have them.

- Consumer bank account program management: If you are creating bank accounts for consumers, you will need to provide your customers with periodic statements, a customer service phone number, and a process for dispute intake and resolution.

Financial due Diligence

In order to provide you with a reduced reserve amount, we ask you to submit basic information about your company and standard financial statements so we can properly evaluate the financial and operational risks of partnering together. This includes, but may not be limited to: Company overview, Compliance team overview (if you have one), most recent Financial Statements, all liabilities (on and off balance sheet).

Implementation steps

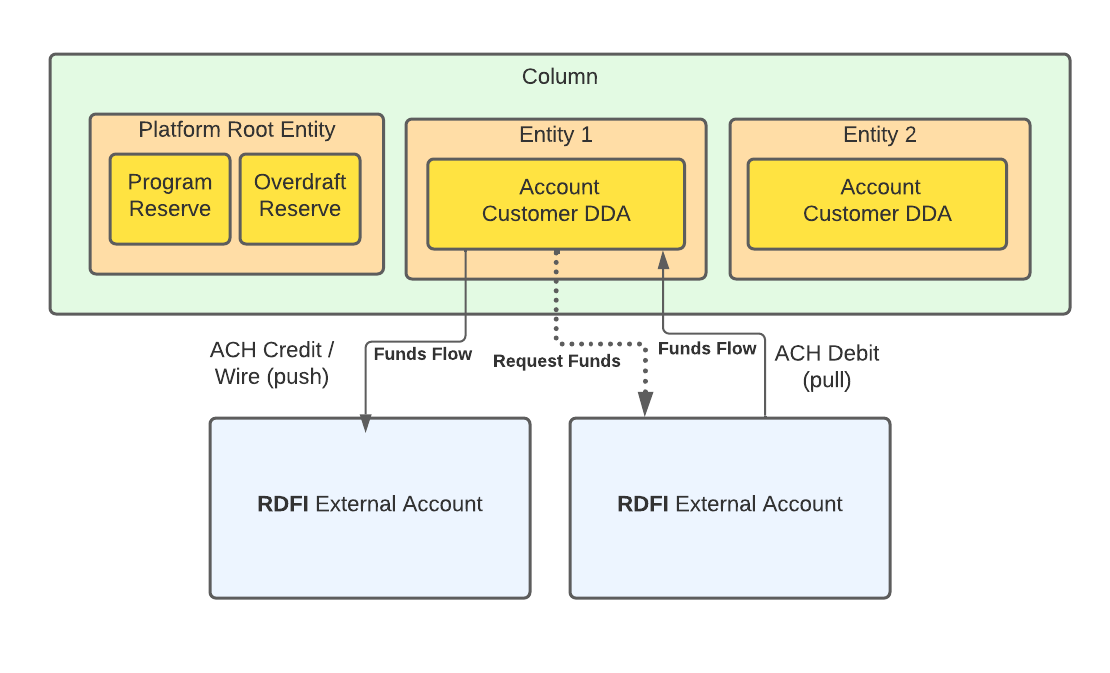

Create your data model

- One Root Entity which has gone through KYC / KYB

- Program Reserve and Overdraft reserve Bank Accounts (created automatically) which belong to the root entity. See here for more information on these accounts.

- An entity for each end consumer/business which has gone through KYC / KYB

- A bank account for each entity, for which a customer has signed a DDA agreement

Flow of funds

Step-by-step flows for money movement

- Switch your platform to live mode

- Create non-root entities and accounts

- Leverage the Column APIs to build your neobank

Switch your platform to live mode

To switch your platform to live mode, follow the instructions here.

Create non-root entities and accounts

You should create an entity and account for each customer for whom you are opening a demand deposit account. Non-root entities and accounts can be created both via the dashboard and with the API. Each entity you create needs to go through KYC/KYB.

Leverage the Column APIs to build your neobank

You can now use the Column APIs to provide banking services to your customers. Consider the following flows:

- Build a flow that enables your customers to sign up for an account for your neobank (collect their information, conduct KYC/KYB, create an entity + account...etc).

- Enable your customers to fund their bank accounts by using an ACH debit to pull in funds from an external account.

- Enable your customers to send money to external bank accounts through ACH credits and wires.